Insurtech, or insurance tech, is the newest trend to hit London and it is booming. Investment in UK insurtech companies was at £218m in the first half of 2017, according to Accenture and CB Insights, up from a mere £7.8m in the same period last year.

Phoebe Hugh, CEO, Brolly

Riding this wave of interest and expansion in the industry is Phoebe Hugh, CEO and co-founder of London-based insurance artificial intelligence (AI) app Brolly.

Hugh started working in the insurance industry after leaving university, at industry giant Aviva. After moving through different parts of the business, from underwriting property and liability insurance up to high-net worth insurance and price comparison, Hugh worked out a couple of things wrong with the industry.

“Most of the time when I mentioned insurance to anyone outside of the industry they would start telling me their problems. I started realising that people don’t really understand what they’re buying, as it’s more of an opaque place than the banking sector,” says Hugh.

With the average spend per year on insurance products is around £1,500 in the UK, Hugh says that people are spending money they don’t need to under the current system.

“Say you have seven different products, from seven different advisors, who deliver it in a different way. You end up an expensive, non-joined up portfolio that’s probably not right for you and a bit of a mess. I quit my job two years ago to solve that.”

Using AI to bring clarity to insurance

After leaving Aviva, Hugh studied programming at Makers Academy to learn the technology she needed to kickstart Brolly. After meeting Alice Bentick from Entrepreneur First (EF), a startup accelerator, Hugh joined the next EF cohort and met her co-founder, Mykhailo Loginov whose background includes stints at Microsoft and Skype.

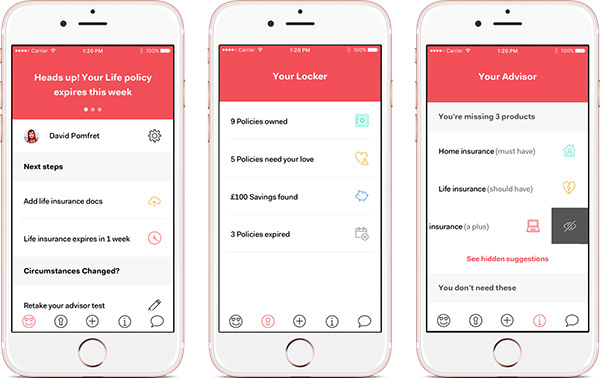

After this, Brolly was born. As an app, it brings together all your insurance policies so you know where you stand. The Locker helps you manage your policies, the Advisor is there to help you understand what your policies are and offer advice, and the Shop helps you purchase new policies.

“We’re starting to test machine learning models that are becoming significant, and it’s really exciting.”

The Locker aspect incorporates machine learning and AI to collate all your policies from your email address.

“Right now, it’s an algorithm that uses heuristic passing. But we’re starting to test machine learning models that are becoming significant, and it’s really exciting. That’s where we’re able to identify insurance policies and find all the information in there even faster than we can do now.”

Autonomous insurance advice

AI also comes into play in the Brolly advisor. New customers take a test which asks them questions on their lifestyle, financial position and assets to give them advice about what policies they do or don’t need.

“It’s trying to give you various insights and that’s really helpful for people because right now no one is telling you that and you have to figure it out by yourself,” says Hugh.

“Without techniques like machine learning we couldn’t recommend products other users have bought but we will be able to do that with our technology later this year.”

“That recommendation is currently an expert system, part of AI but not machine learning. It’s based on rules and also trained by an expert,” she explains.

Through the work of its beta app, analysing and understanding customer policies, Brolly is building up its data cohort. If there’s one thing machine learning needs, its data, and insurance has a lot of it.

“Without techniques like machine learning we couldn’t recommend products other users have bought but we will be able to do that with our technology later this year. It’s pretty core to our future; we wouldn’t be able to reach our long-term vision without it.”

AI: more than just a chatbot-fuelled trend

However, it’s important for Hugh that AI isn’t only a part of Brolly because it is a major trend in insurance at the moment.

“We didn’t say, ‘let’s build a chatbot because it’s cool’. Instead, it was ‘let’s actually figure out our AI and how these new technologies really help the experience’, because ultimately that’s what the customer cares about,” she explains.

This is also a way for the startup to work with established players like ERV, a travel insurer and Hitchcocks so it can sell their products through the app. Older companies don’t necessarily have the drive or the team to bring in this kind of technology.

“We’ve got some great insurance partners that we’re working with and I think the most exciting thing for them is that a lot of it they can’t do themselves. They really see us as a way of tapping into a new market that they haven’t previously been able to capture.

“We’re shaping the next generation of insurance distribution and they want to be involved.”

“We didn’t say, ‘let’s build a chatbot because it’s cool’. Instead, it was ‘let’s actually figure out our AI and how these new technologies really help the experience’.”

And it appears to be working. In July this year, Brolly announced it had raised £1m in seed funding from the likes of Entrepreneur First and Valar Ventures, the US based venture fund backed by Paypal’s Peter Thiel.

The startup is going to use this investment to propel Brolly forward and keep insurance innovative. Thanks to all the data it’s collecting, Brolly ultimately wants to learn everything about its customers so it will be able to create its own products, based on their individual preferences, to them.

“We’re not just distributing products; we’re working towards building accurate, personalised insurance products around people’s lives,” says Hugh.

“We want to see if there are gaps that aren’t currently being fulfilled in the market, where we can build our own ‘brolly polys’, which are our Brolly-branded products.”

With the startup’s success so far, Brolly is certainly one to keep an eye on the insurtech space, and may even encourage a wider embracing of AI in insurance beyond the humble chatbot.

Images courtesy of Brolly